what items are exempt from sales tax in tennessee

Food in Tennesse is taxed at 5000 plus any local. 2022 Tennessee state sales tax.

Which States Require Sales Tax On Clothing Taxjar

Beginning at 1201 am.

. STH-8 - Types of Clothing Items that Qualify for Sales Tax Holiday Exemption Clothing is defined as human wearing apparel suitable for general use. Generally contractors and subcontractors are users and consumers and must pay tax on the purchase price of materials supplies and taxable services that are used in the. 18 rows In Tennessee certain items may be exempt from the sales tax to all consumers not just.

Mining Photography Printing Digital Products Contractors Water Pollution Control Prescription Eyewear. The total sales price of specified digital products is subject to the 7 state tax rate and a standard local tax rate of 25. Ad Keep up with changing tax laws.

Some exemptions are based on the product purchased. Get the Avalara Tax Changes Midyear Update today. Information for farmers timber harvesters nursery operators and dealers from whom they buy to understand the scope of exemptions and reduced rates the purchases.

Clothing items must be. Taxable and exempt shipping charges Colorado sales tax may apply to charges for shipping delivery freight handling and postage. With local taxes the total sales tax rate is between 8500 and 9750.

Is freight taxable in Colorado. Exempt if 100 or less per item. Get your free copy of the Avalara Tax Changes Midyear Update to see whats new in taxes.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. If a business qualifies as a manufacturer sales made from the qualified location of items not manufactured at that location but incidental to the businesss manufacturing sales. School and school art supplies with a price of 100 or.

67-6-102 67-6-233 and. However a detailed list of exemptions to this rule. Items Not Taxable at the 400 Food Rate 25.

For example gasoline textbooks school meals and a number of healthcare products are not subject to the. Are Medical Goods and Services subject to sales tax. Effective October 1 2020 Page 23.

Exact tax amount may vary for different items. While Tennessees sales tax generally applies to most transactions certain items have special treatment in many states when it. During the holiday the following items are exempt from sales and use tax.

43 rows In the state of Tennessee sales tax is legally required to be collected from all tangible. The Blanket Exemption Certificate is utilized for all. On July 27 shoppers wont have to pay sales tax on a wide range of items including clothing school supplies and computers.

The state sales tax rate in Tennessee is 7000. The Tennessee sales tax exemption for manufacturing also. During the period beginning at 1201 am on Monday August 1 2022 and ending Wednesday August 31 2022 at 1159 pm food and food ingredients are exempt from sales tax.

Get your free copy of the Avalara Tax Changes Midyear Update to see whats new in taxes. Get the Avalara Tax Changes Midyear Update today. Clay School art supplies are exempt.

Among sales tax exclusions on goods are exemption for prescription medicine and gasoline. Composition Books School supply. Customers in the previous 12-month period are required to collect and remit Tennessee sales tax.

Municipal governments in Tennessee are also allowed to collect a local-option sales tax that ranges from 15 to 275 across the state with an average local tax of 2614 for a total of. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is. Counties and cities in Tennessee are allowed to charge an.

Clothing with a price of 100 or less per item. The state of Tennessee provides only one form to be used when you wish to purchase tax-exempt items such as prescription medicines. Ad Keep up with changing tax laws.

Tennessee tax-free weekend 2021 School supplies such as pencils and binders and clothing items including shirts pants socks shoes and dresses under 100 will be tax. The following is a press release from the National Coin Bullion Association announcing that Tennessee has become the latest state to have sales tax exemption on retail. Several examples of items that are considered to be exempt from Tennessee sales tax are medical supplies certain groceries and food items and items which are used in the.

Services are considered to be non-taxable.

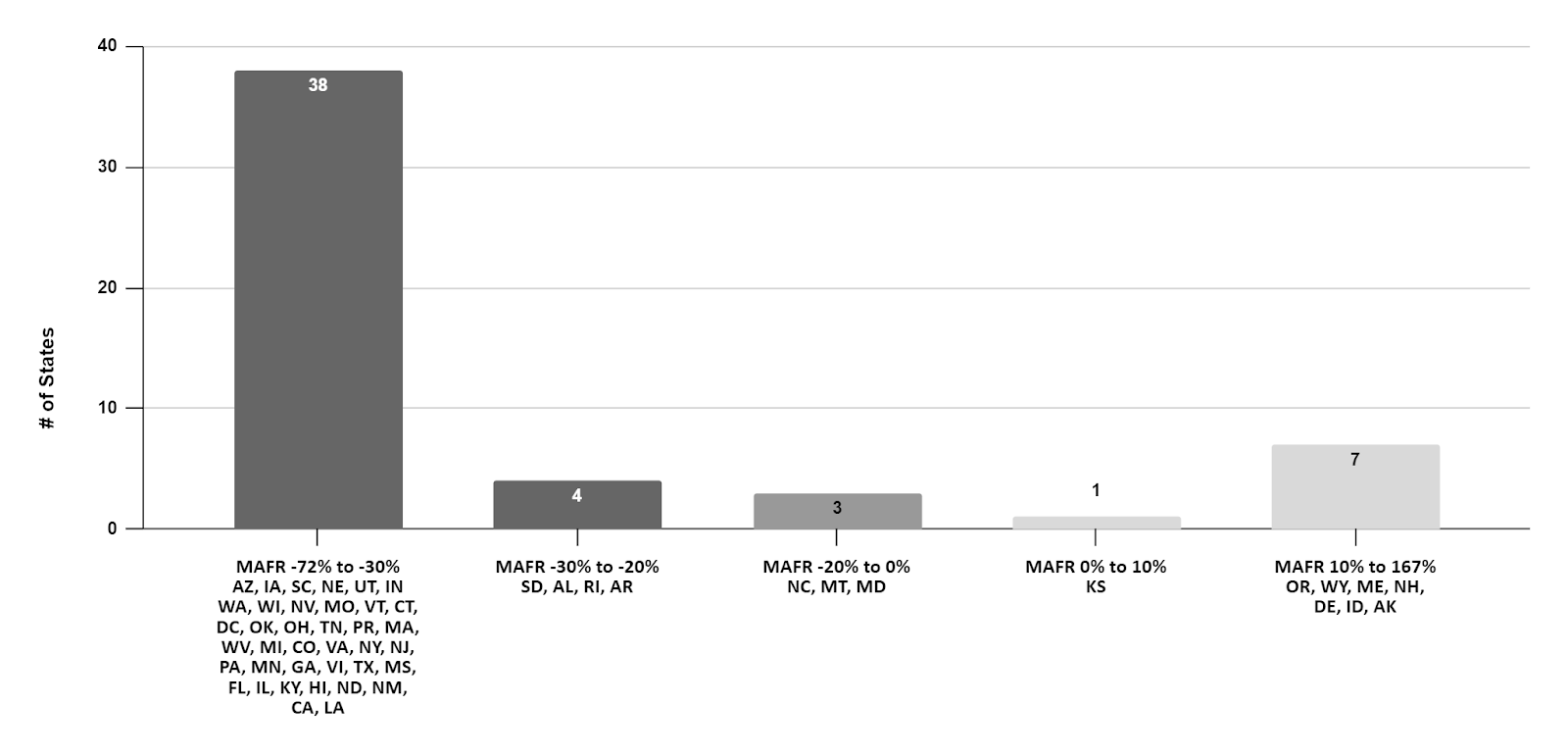

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Shopping On The Internet Without Paying Sales Taxes Makes You A Tax Cheat In Almost All States National Globalnews Ca

Tennessee Car Sales Tax Everything You Need To Know

Alabama State Taxes 2022 Tax Season Forbes Advisor

Crypto Taxes How To Calculate What You Owe To The Irs Money

List Of Tax Exempt Items Baby Receiving Blankets Emergency Kit Tax Holiday

Taxes On Food And Groceries Community Tax

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Taxes On Food And Groceries Community Tax

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Which States Require Sales Tax On Clothing Taxjar

Taxing Goods And Services In A Digital Era National Tax Journal Vol 74 No 1

How To Charge Your Customers The Correct Sales Tax Rates

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

How Do State And Local Corporate Income Taxes Work Tax Policy Center

How To Charge Your Customers The Correct Sales Tax Rates

Tennessee S Marketplace Facilitator Sales Tax Law Explained Taxjar

Taxing Goods And Services In A Digital Era National Tax Journal Vol 74 No 1